Malaysia Tax Reforms

4 min read

- Tax reform is a process where the government changes how the way to collect taxes whilst managed by the government to improve the economy and benefits of the country. Tax reform also includes increasing or reducing the level of taxation to make the tax system more progressive or less progressive.

The key benefits of a tax reform are as follows:

i. It will support the long term economic growth where smaller businesses and smaller corporations tax rates will eventually lead to an increased investment, increase in wages and increase in job opportunities.

ii. The long term economic growth is also supported when immediate deductions of tax for tangible property will provide more businesses to invest further on new machinery and PPE or plant, properties and equipment. This will eventually also lead to a higher business growth and better business productivity.

iii. When Malaysia embraces a much modern and territorial tax system in comparison to international tax systems, will eventually make Malaysian companies more competitive and will eventually eliminate the need of Malaysian corporations from moving their wealth overseas in the pretext of tax evasion and avoidance due to obsolete and back dated tax systems.

iv. When a government implements an acceptable and competitive tax reform, will eventually lead to an impediment to investing into the country; Malaysia. This will also create a likelihood creating more jobs, business growth and increase the country’s GDP or typically on the standards of living.

v. When a country such as Malaysia keeps reforming its tax system, will eventually lead to an increased need for tax planning by individuals and businesses which is considered to be a healthy ethic as a Malaysian.

vi. Even though there are many tax reform issues to remain unresolved, individuals or businesses will still tax planning to align with current tax information and contemplated transactions. This is so since tax planning will be critical for individuals and businesses who will want to get the maximum benefits out of their tax declarations.

- There are 3 main tax reforms in Malaysia which are:

Tax Reform 1

- On 1st January 2005, Self Assessment System was introduced where there was the introduction of the E-filing or online system for filing of tax system. Filing of tax for individual and businesses will be done fully over the internet.

- Individuals with total income tax equivalent to the amount deducted under the pay as you earn system can opt to not submit a tax return which is subject to certain conditions to be fulfilled.

Tax Reform 2

- This reform is when the GST or Goods or Service tax was abolished on 1st June 2018 and there was an introduction of additional taxes.

- In this period, the considered to be a redundant tax system which is the SST or Sales and Service Tax was reintroduced.

- In this period too, sugar tax, airport tax and several other taxes were introduced into this reform.

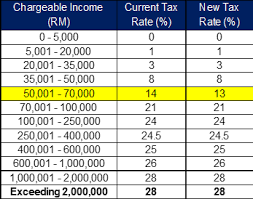

- Tax rates for small and medium companies with a paid up capital of less than RM2.5Million and income with less than RM500,000.00 were reduced.

- Effective January 2020, a digital tax was introduced for foreign service providers.

Tax Reform 3

- During this tax reform period which was introduced on 2nd November 2018, there was an introduction of a Special Voluntary Disclosure Programme (SVDP). This system was introduced to encourage tax payers to voluntarily disclose any undeclared income taxes and to settle arrears from previous years.

- Tax payers were assured that all voluntary disclosures would be accepted in good faith without further penalties. This programme eventually lead to a significant 390,000 numbers of ex-defaulters or tax evaders.

The 5 measures that Malaysia took in making sure that a tax reform is successful are as follows:

i. Tax Revenue Diversification

The main target of this initiative is to make sure that sustainable tax revenues are imperative to reduce the current government deficit but closing the tax gap. Another aim of this initiative is to broaden the taxpayer base whilst making sure that for social well being, individual and business income taxes must be based on the ability to pay.

ii. Strengthening Tax Compliance and Governance

To make sure that tax revenues are augmented, Malaysian tax authorities will need to look at stricter enforcement and compliance which alone could fetch higher tax revenues. The ongoing Special Taxation Voluntary Disclosure or STVD programme offering tax amnesty for tax evaders and tax avoiders are one of the current measures to improve compliance and broaden the tax base.

iii. Assessing Incentive Effectiveness

The Malaysian tax authorities will analyse and formulate incentives and taxation to make sure that Malaysia is on track on global competitiveness and to also make sure to optimise government spending on incentives. It is also important to constantly update incentives and policies to keep up with rivals in the internecine war for business and investment.

iv. Trimming Corporate Tax Rates to Stimulate Businesses

Malaysia is already studying from other countries by trimming public sector personnel and government spending which can be utilised to reduce corporate tax rates. As proven by countries such as UK, Germany, Spain and France which recorded a higher GDP from higher FDI or Foreign Direct Investments in year 2015 when they reduced their corporate tax rates.

v. Leveraging Tax Policies to Draw FDI

While Malaysia is suffering a declining FDI (18% overall) against an increasing overall ASEAN FDI, Malaysia is experimenting with tax policies to entice and increase FDI. This is a fact when even Malaysian companies are moving to Thailand because the cost to do business in Malaysia is ever increasing.

Other than looking at costs of doing businesses, Malaysia is also looking at the following 3 categories to lure FDI:

a. Efficiency-seeking investors looking to manufacture more efficiently and cost-effectively;

b. Market-seeking investors wanting to sell to Malaysia and other countries in the region;

c. Resource-seeking investors wanting to buy resources like electricity to increase their capacity.